If you have followed my comments about Prop 47 and how we were duped into believing this legislation was good for California, you now know…it was not.

Titled “Safe Neighborhoods and Schools Act” the bill sailed through with a majority vote yet, really had nothing to do with safe anything. In fact, Prop 47 has had a detrimental effect on civil order in California. It placed a dollar amount of $950 of loss before it became a crime. That in itself is a crime.

Different than being a little bit pregnant, Prop 47 allows crooks, looters, and felons to be petty crooks without consequences.

Oh, that’s right. They can receive a “ticket” if they are caught.

What the bill did do, is: release thousands of felons onto the streets of California.

Theoretically, the release of prisoners saved the state over $100 million. However, the savings were soon eaten up in the amount of property that was vandalized, items that were shoplifted, and personal valuables that were stolen.

Now, we know why the Police Chief Association of California opposed this clever sounding but sinister resulting legislation that WE voted for.

Do you think there is any correlation between the 50% increase in petty theft since the passage of this bill in 2014? There is nothing safer about our schools and neighborhoods!

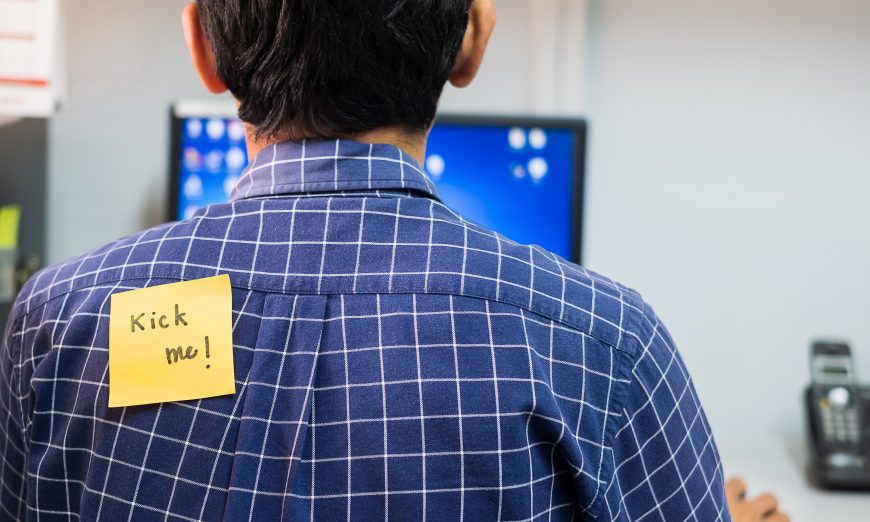

Face it folks. We were duped.

Now, these same legislators, the ones we elected, are out to try it again by butchering Prop 13. This bill has already qualified for the November ballot.

You might be surprised to learn this bill is designed to raise about $12 billion in property taxes.

It is called “The California Schools and Local Communities Funding Act of 2020” — aka the “split-roll” initiative.

Using a well proven and motivating topic like “schools” these money hungry legislators are out to bust Prop 13 at the cost of commercial property owners.

If this portion of Prop 13 is repealed for commercial property owners, it will in turn raise rents for tenants. The ripple effect is staggering. Backers do not discuss the impacts in detail.

Commercial properties will be taxed at market value as opposed to purchase price.

Even worse, the backers of this bill have made it known if they win this one, they will then go after homeowners and repeal the rest of Prop 13 so you would be taxed at market value.

Can you imagine what kind of tax bill you would have if you were taxed on market value and not your purchase price? This would be devastating for many, and crippling to seniors.

God I love our teachers. They are terrific and do an amazing job. However, their Association, The California Teachers Association, has budgeted $6 million to help pass this split-roll initiative.

Is there no end to the god-awful games in grabbing for taxes?

No! There is no end. Legislators and special interests will syphon off every dime they can tax and spend it without even blinking.

Don’t be duped again! This time don’t give up your wallet.

Just say no to the “California Schools and Communities Funding Act of 2020.”

Let me address a few miss-statements in this piece regarding the Schools and Communities First Act. 1) this is a citizens initiative, so the legislature is required to place it on the ballot. 2) it addresses a long standing corporate tax loophole that freezes commercial property tax assessments at 1978 rates if title does not transfer due to ownership change, when less than 50% of ownership does not change, then the sales price is not imposed as a new assessment. Based on studies about 6% of commercial property once reassessed at market rates will bring in 70% of new revenue. 3) commercial property assessed at $3M or less is exempt from this Act. 4) small businesses, like my husbands office, rent at market rates, there is no discount for a landowner with lower property taxes, so landowners pocket savings. 5) when prop 13 passed in 1978 revenue from property taxes received were split 50/50 between residential and commercial properties, today residential receipts outpace commercial 75/25 in Santa Clara County. 6) if passed, commercial property will be assessed at 1% of new market rate, this will restore better revenue balance. 7) if Prop 13 is repealed, as this article suggests, a new initiative will go before voters, the legislators cannot repeal independently. I hope this helps everyone evaluate this Act, as it will bring about $1B in new revenue to Santa Clara County from corporate campus headquarters build on former agricultural land assessed at pennies on todays dollar.

Dear Ms. Shepherd:

You stated commercial property assessed at 3 million or less is exempt from this act. This is not a true statement. If you read the bill carefully it is aggregate value of the commercial property owners. So if an individual owns two properties of 2 million each then both properties are reassessed. Furthermore, if the properties are owned by an LLC and any of the partners combined own over 3 million dollars in commercial real estate aggregate, the property is reassessed even if the value if is less than a million dollars. But the biggest deception of the bill is that it exempts small businesses from property tax. They fail to mention that this is business property tax not real estate property tax. Business property tax (computers, equipment, etc.) is insignificant to small businesses. But if you will allow me, this bill hurts small business the most and rewards big businesses. I bought a commercial building in 1999 for 1.2 million dollars. Today my taxes on the building are $20,000 a year with the value of the building being about 4 million. My business occupies 60% of the space and I lease out the rest. The building is 12,000 square feet. If this bill passes my taxes would be $60,000 a year on the building. This additional $40,000 a year would be passed unto my business and the other businesses in our building. This amounts to .28 cents a square foot per month which will have to be directly passed to the consumer. They are selling this bill as protecting small business, nothing further is from the truth. This bill is a small business killer.

I plan to vote NO on the “California Schools and Communities Funding Act of 2020 and any other proposition that weakens Proposition 13 and I will be reading this proposition closely. Not every commercial property owner is greedy. All the increase in taxes trickles down to us the owner, renter, or customer increasing what we pay.

There is no end of the new taxes with no clear free of the nice speeches simple in/out accountability and benefits for the people paying the taxes. Better schools, roads, less crime, less homeless are all tags we heard to increase the taxes, but none of those got better except of the benefits to our legislators. How about to report how much money you saved, how much every collected tax dollar yield to the taxpayers, how much the new property taxes from the more dense built cities and businesses in CA were collected and spent?

CA leaders look good and generous at TV spending w/o accountability money left and right, and then they reduce the money going back to the counties and want more taxes to collect from the people actually working for the money.

No more additional taxes. Each additional $ collected make the people paying taxes in CA poorer and less willing to live here.