With the 49ers first preseason game on Aug. 9 and Beyoncé and JAY-Z’s upcoming concert on Sept. 29, the topic of short-term rentals and hotel tax rears its head again.

These events and the usual stream of business travelers draw visitors from all parts of the country. Oftentimes, stadium visitors would rather crash nearby than fight through the famous Levi’s Stadium traffic and opt to rent a hotel room or short-term rental like Airbnb.

Transient Occupancy Tax

Since October 2015, short-term rentals made through Airbnb in Santa Clara have been subject to Transient Occupancy Tax (TOT), also known as the hotel/motel tax. The City of Santa Clara and Airbnb — the leading online short-term rental platform — agreed to enter a voluntary tax collection agreement. This agreement means that Airbnb collects a 9.5 percent tax from guests on bookings made in Santa Clara on behalf of the site’s hosts and passes, or remits, the tax on to the City. Airbnb has over 400 similar agreements with jurisdictions around the world.

Specifically, the City of Santa Clara’s TOT code requires that any person or business engaged in the renting of any number of rooms for lodging, dwelling or sleeping purposes, must collect, report and remit TOT, according to the City’s website. This includes not only Airbnb, but also hotels and motels — it should also include other short-term rental platforms but the City doesn’t have agreements with other platforms such as Home Away.

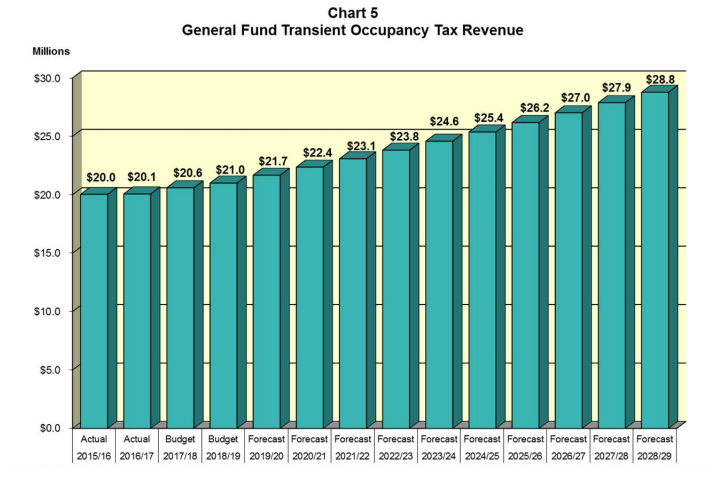

According to the City’s Ten-Year Financial Plan, the current revenue from the TOT is approximately $21 million per year but is forecasted to grow at a rate of 3.2 percent per year. The financial plan describes the revenue as “volatile” since it is sensitive to economic trends — in other words, it is not a reliable, steady stream of revenue.

“In the City of Santa Clara, Airbnb remits the tax revenue on a monthly basis to the City, and the City uses the revenue however it would like,” said Jasmine Mora, Airbnb’s Public Affairs Manager in California.

According to a May 29 Council meeting presentation, revenue from TOT is used for “general local government purposes” like libraries, parks and recreation, police and fire.

Currently, 37 business pay TOT, including online rental sites, according to the presentation.

The Hosts

“There are 700 Airbnb hosts in the City of Santa Clara,” said Mora. “Forty-nine percent of Airbnb guests to Santa Clara are from California.”

Minh Le has a listing on Airbnb titled “Mini-studio near Levi’s Stadium” that goes for $72 a night. Le advertises a private room in his house where he and his family also live. He said he lists his home to get additional income for his family.

The listing’s description says, “The main entrance to Levi’s Stadium (on Tasman) is about 1.3 mile walk.” However, Le said that the listing’s proximity to the stadium does not actually help him get more bookings — he said he gets less than 10 bookings a year.

Many hosts in Le’s area tout their home being near the stadium as a selling point. Some reviewers rave how great the location is and some saying they have stayed at a specific home multiple times.

“Originally, I thought it as such and it should get more bookings,” said Le when asked if he believed that the fact that his home is near the stadium was a selling point to guests. “BUT real bookings are only for professional workers in the valley.”

Le’s listing is also very close the Santa Clara Convention Center and businesses located near the stadium.

The Future of the Transient Occupancy Tax

In May, the Santa Clara City Council considered increasing TOT to increase revenue to the City.

According to the presentation made at the May 29 City Council meeting, Santa Clara’s 9.5 percent TOT is currently second to the lowest TOT in the county — Gilroy’s is 9 percent, San Jose’s is 10 percent and Palo Alto’s is 14 percent. The presentation stated a 1 percent increase would generate an additional $2 million in revenue. However, the City decided against asking voters if they want to raise TOT in the November election and opted for a cannabis tax instead.