Improved finances aren’t the only bright spot in Santa Clara’s 2019-20/2020-21 budget. The other is a brand new format for the City budget book.

The two-year budget instituted last year by City Manager Deanna Santana reduced this year’s budget effort and opened up time for the redesign, explained Santa Clara Finance Director Angela Kraetch at the May 7 City Council meeting.

The book now includes a glossary and explanations of municipal finance and acronyms. There are also revenue and expenditures summaries in descending levels of detail, illustrated with charts of the City’s finances.

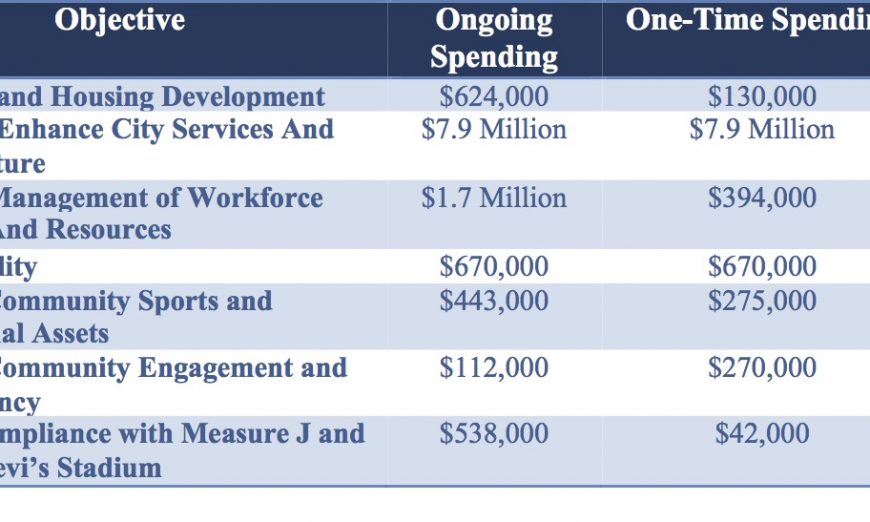

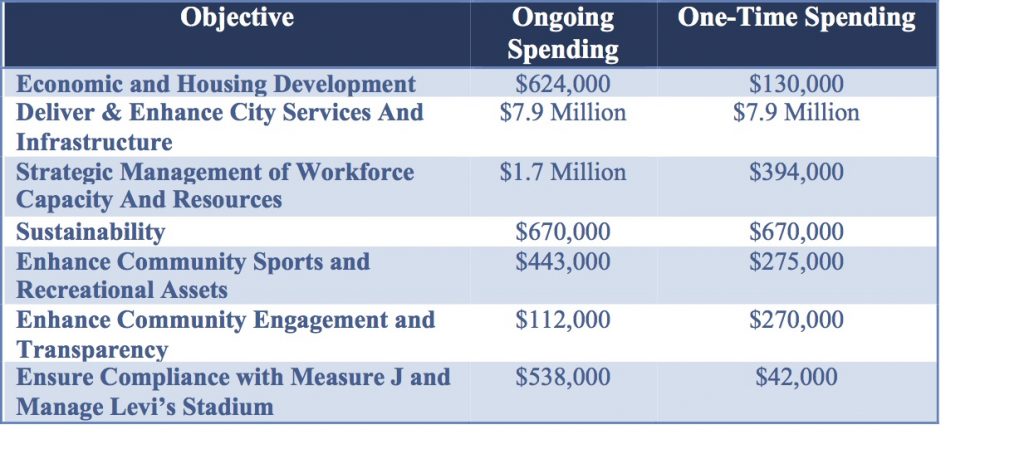

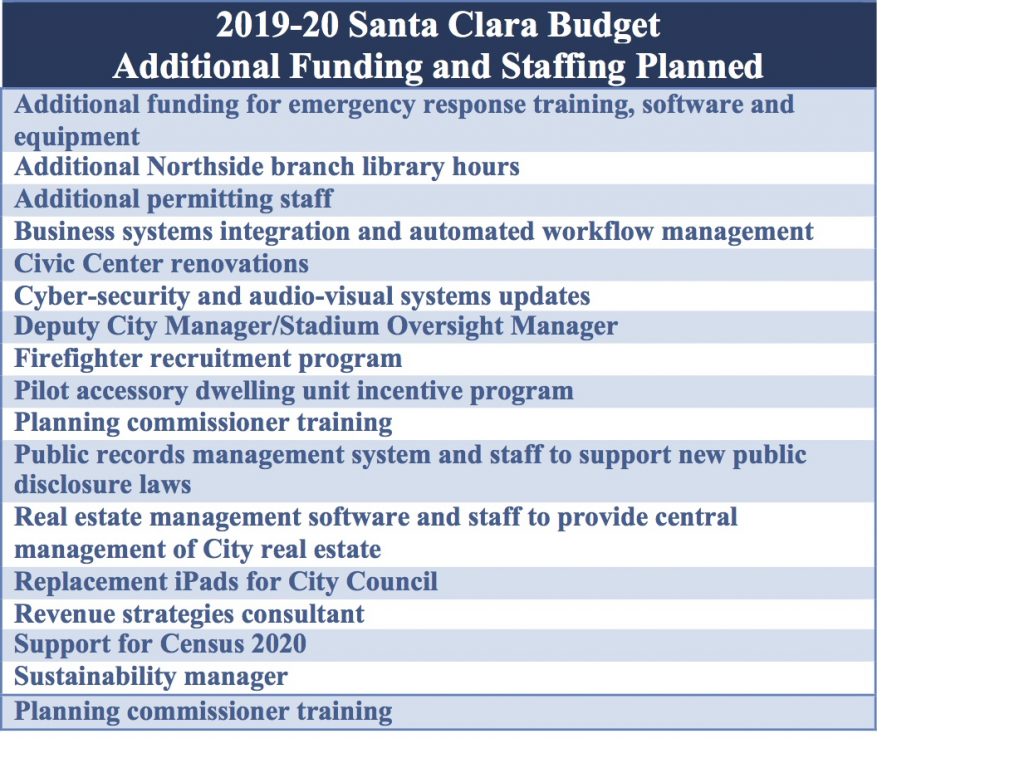

The new budget also breaks out costs for salaries, overtime, benefits and pensions and shows how spending lines up with stated City Council objectives — staffing additions, consultants, and one-time and ongoing costs.

Balanced Budget, But “Fragile”

The City’s budget will grow 1 percent to $955 million in the coming year and another 4 percent to $992 million in 2020-21. Santa Clara’s electric utility — Silicon Valley Power — accounts for 55 percent of the budget, which goes for purchasing, generating and delivering electricity.

Last year’s forecasted deficits have turned around, with small deficits in 2021-22 and 2022-23 — $1.6 million and $500,000 respectively — and surpluses between $700,000 and $2.6 million through 2029. This year is expected to close with a $1 million surplus, and next year with a $100,000 surplus.

The Budget Stabilization Reserve — formerly the general fund emergency reserve — is projected to reach $56 million this year.

By City policy, general fund reserves should be enough to run the City for three months. This means for 2019-20, the reserve should be $62 million and $63 million in 2020-21. The City anticipates closing the current fiscal year with sufficient surplus to bring the fund up the prescribed level.

But good news comes with a qualifier.

“The forecast shows surpluses and deficits that are modest and highly sensitive to unexpected changes in … revenue or expenditures,” City Manager Deanna Santana’s wrote in her budget transmittal letter. Deficits will be addressed, Santana wrote, with “ongoing solutions” — steps to permanently reduce costs rather than one-off cuts.

“The budget continues to be fragile,” Santana wrote, with “indications for a potential economic slowdown in the near future” as well as “other factors” that could change the picture.

These other factors include: less revenue from Levi’s Stadium events, economic downturn, increased labor costs, CalPERS actuarial changes, lost tax revenue from deferring a commercial cannabis tax, and changing infrastructure needs and requirements.

Notably, the City is forecasting $2.7 million profit from non-NFL events for next year, while the 49ers forecast $175,000 — which alone could turn next year’s $100,000 surplus into a $2 million-plus deficit.

General Fund Revenue Up

In 2019-20 the general fund — the money spent to run the City, exclusive of capital improvements and utilities — will grow from $245 million to $247 million (less than 1 percent) and to $252 million in 2020-21 (2 percent).

The City’s three major revenue sources — property, business-to-business sales tax and hotel (TOT) tax — are forecast to grow, collectively, by 5 percent. Property tax is the City’s most stable revenue, while sales tax is the most volatile.

Property tax has overtaken sales tax as the City’s largest single revenue stream and is expected to grow 7 percent in both the next two years — from $60.3 million to $68.9 million in 2021.

By contrast, sales tax is expected to grow 3 percent next year to $57.5 million and drop in 2020-21 to $56.1 million. Hotel tax is forecast to grow 10 percent this coming year to $23 million and 3 percent in the following year to $23.8 million.

Permit and license revenue is anticipated to grow from $11.3 million to $11.5 million in the next two years, while rent income is forecast to jump 33 percent to $14.1 million. Revenue from services fees (excluding utilities) is expected to be stable over the next two years, about $41.8 million.

General Fund Expenditures

Salaries, benefits and pensions make up nearly 80 percent of general fund expenditures. In the next two years these costs are expected to grow 6 percent to $198.8 million.

Salaries will grow 9 percent to $128.9 million, while non-pension benefits will drop 2 percent to $21.3 million from $21.8 million.

Pension costs are expected to drop 4 percent to $44.8 million this year — because non-safety pension costs will drop 15 percent — but will grow 9 percent the following year. Public safety pension contributions will grow 4 percent in the coming year and another 8 percent, reaching $29.8 million, in 2020-21.

The City also established a Turnaround Initiative Fund of one-time appropriations for improving business processes.

Fifteen new positions at City Hall will also be added in the coming year, including a Citywide sustainability manager.

Review Santa Clara’s 2019-2021 budget at tinyurl.com/sc-2019-21-budget.