Now the Santa Clara stadium construction financing is in place, what’s the long term plan for paying off that debt? The short answer is that any loans outstanding when the construction is finished will be refinanced into long-term debt.

The timeline looks like this:

- 2012: Initial construction loan

- 2012 – 2014: Seat licenses and naming rights used to prepay or reduce loans

- 2014: Refinance unpaid part of construction loans

- 2015: Maximum maturity date for construction loans

Refinancing – “takeout financing” – can take the form of bonds or loans, according to Gregory Carey of Goldman Sachs, which put together the construction financing deal. The differences between bond financing and bank loan financing depends on several factors:

- Flexibility: Bank loans are pre-payable any time, while bond terms are fixed.

- Costs: Right now both bank loans and bond rates are low.

- Target lenders: Bank loans come from commercial lenders who do business in the NFL market. Bonds are sold to insurance companies and investment funds.

Doing the Stadium Refinancing Math

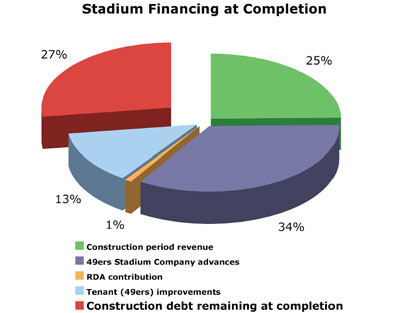

But how much will the Stadium Authority’s final debt be? Here are the current city projections (in millions):

- Total costs: $1,177

- 2012-2014 revenue: $292

- 49ers StadCo loans: $400

- RDA contribution: $10

- 49ers contribution: $155

- Debt at completion: $320

No city, agency or stadium authority funds, assets – including the stadium land – operating revenues, or enterprise funds can used as be used as security for the construction loans. This is specified in Santa Clara City Ordinance 17.20. The collateral for the construction loans is, in essence, the 49ers – a business valued by Forbes in 2010 at $925 million.

Another comparison to note is that Santa Clara’s city-owned electric utility is currently carrying $216.5 million in long-term debt that is secured by the city’s electric revenues, according to financial statements at www.siliconvalleypower.com.

The utility also has “contingent” liability for about $1 billion (about half) of the outstanding debt of the four power generation agencies it belongs to – Northern California Power Agency (NCPA), Transmission Agency of Northern California (TANC), M-S-R Public Power Agency (MSR PPA), and M-S-R Energy Authority (MSR EA). In other words, if one of these agencies defaulted, Santa Clara could be liable to pay part of its debts.