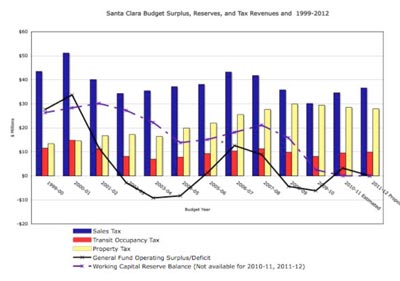

Santa Clara has a balanced budget this year. But the City has no choice. Since 2000, reserves were used six times to balance the City budget in the face of deficits – 2001-02, 2002-03, 2003-04, 2007-08, 2008-09, 2009-10 – leaving nothing much except mothballs in the emergency operating reserves.

None of this should been surprising. City Manager Jennifer Sparacino warned as early as 2004-05 that the city faced ongoing “structural” – rather than “emergency” – operating budget deficits and dangerously declining reserves.

But it wasn’t until 2010, when the reserves were almost completely depleted, that the City Council found the political will to address the deficit and cut operating expenses, two-thirds of which is compensation for city employees. Even then, the choice was for short term savings – employee furloughs and a moratorium on raises – rather than addressing underlying causes – such as escalating mandatory contributions to California’s public employee pension program, CalPERS.

The current deficit reprieve will be short-lived, according to the City Manager’s transmittal letter for the proposed 2011-12 budget. Beginning in 2013, structural deficits will return as furloughs end in the middle of fiscal year 2013-14.

To balance the budget last year:

- The city froze or left vacant 100 open full-time positions, cut about 9 full-time positions, and negotiated with eight of the city’s employee unions for pay concessions – one day a month furloughs and a moratorium on raises. Two of the city’s unions chose layoffs rather than concessions.

- The City Manager and elected officials took voluntary salary or stipend cuts.

- As-needed staffing and overtime budgets were reduced.

- Fees and charges for services were increased to move closer to full cost recovery.

- Materials, services, and supplies budgets were pared to a bare minimum.

- The city sold its Altamont Pass property to the city-owned electric utility (Silicon Valley Power).

Despite these savings, salary, benefit and pension expenditures will grow $2.7 million -1.9 percent – in the coming fiscal year, due primarily to growing benefit and pension costs. One savings that Santa Clara wasn’t able to implement was a “fresh start” refinancing of its CalPERS unfunded liability – similar to refinancing a mortgage. CalPERS denied the city’s refinancing request.

When the reserve fund was established in 1985-86, the objective was to maintain 90 days – or 25 percent – of operating budget in case of financial emergencies or natural disasters. Currently, those reserves are about one tenth of that amount.