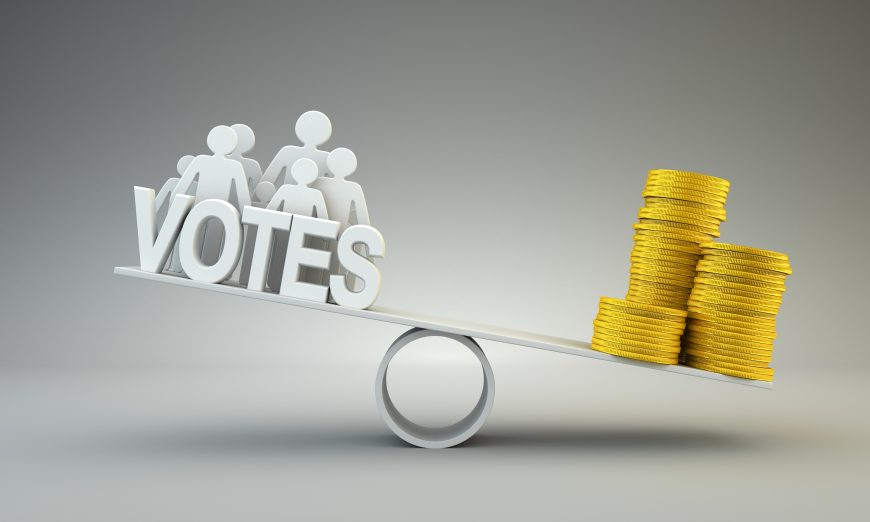

Developers and landlords across California are pouring money by the boatload into the Californians For Responsible Housing PAC’s campaign against state Proposition 10, which would repeal a state law that limits the ability of city and county governments to impose rent control.

(Prop 10 doesn’t impose any rent controls, nor require any local government to do so, although the costly TV ads would have you think otherwise.)

Some of the Anti-Prop 10 PAC funders are familiar names in the South Bay, and were the deep pockets for independent “gray money” PAC expenditures locally.

Equity Residential (Laguna Clara, 3131 Homestead) tops the list with $3.7 million in total donations to the anti-Prop 10 campaign. Taking second place in the multi-million-dollar donor club is the California Association of Realtors, a player in Sunnyvale politics, with total donations of $2.5 million.

Essex Property Trust (Gateway Village, 3700 El Camino) is close behind the Realtors Association with $2.4 million in donations. The California Apartment Association — another regular money player in local elections — takes third place with a $1.8 million donation.

Prometheus (Moonlite Lanes at Keily and El Camino, and 575 Benton) comes in fourth with $1.6 million donated so far, while George Marcus/Summerhill (Lawrence Station, 3505 Kifer) is close with a $1.5 million donation.

Spieker investment and real estate companies have donated $780,000, while Sares Regis (Cityline Sunnyvale) has donated $270,000.

Related Companies (City Place) gave $150,000 — in 11 separate donations — and SCS Development/Steve Schott (1375 El Camino) threw $40,000 into the fight.

Contributions and spending reports for statewide PACs and campaigns can be found at cal-access.sos.ca.gov.

VACANCY TAX: BETTER THAN RENT CONTROL

Rent control doesn’t force owners to offer their properties “to let” at the allowed rent. Rent control doesn’t force land owners to build more housing. On the contrary, it discourages both, reducing the supply of housing, and therefore RAISING the rents of whatever part of that supply is not subject to rent control. Exempting NEW buildings from rent control may avoid deterring construction, but it still doesn’t open up EXISTING buildings for tenants. Worse, it means that the stock of rent-controlled housing becomes a shrinking fraction of the whole housing stock — unless the exemption is only for a limited time, in which case you’re discouraging construction again!

Will removing regulatory barriers to construction solve the problem? Not by itself, although it’s obviously a necessary condition. Cheaper housing requires developers, builders, and owners to increase supply to a point where it reduces their return on investment. They obviously won’t do that voluntarily. They will do it only if they are penalized for NOT doing it.

SOLUTION: Put a punitive tax on vacant lots and unoccupied housing, so that the owners can’t afford NOT to build housing and seek tenants. By reducing the owners’ ability to tolerate vacancies, a vacancy tax strengthens the bargaining position of tenants and therefore reduces rents. It yields both an *immediate* benefit, by pushing existing dwellings onto the rental market, and a *long-term* benefit, by encouraging construction.

Such a tax, by reducing the cost of housing, would make it easier for employers to pay workers enough to live on. A similar tax on commercial property would reduce rents for job-creating enterprises. That’s GOOD FOR BUSINESS and GOOD FOR WORKERS.

A vacancy tax is also GOOD FOR REALTORS because they get more rental-management fees for properties coming onto the rental market, plus commissions from any owners who decided to sell vacant properties to owner-occupants (who of course don’t pay the tax).

Best of all, the need to avoid the vacancy tax would initiate economic activity, which would expand the bases of other taxes, allowing their rates to be reduced, so that the rest of the city/state/country gets a tax cut!

1. Michael Weinstein spent $22 million of AIDS patients’ money in support of Prop 10. That dwarfs the several millions by the biggest opposition.

2. “Prop 10 doesn’t impose any rent controls” – what Prop 10 really does is to remove a state law protecting new construction, single family homes, and vacant units from rent control. If Prop 10 passes, some jurisdictions WILL IMPOSE that sort of rent control.