BREXIT Fallout in Santa Clara?

The Santa Clara City Council couldn’t know last Tuesday evening that Great Britain would vote itself out of the European Union by Friday morning, and put financial markets into turmoil. But the Council could be expected to build the unexpected into the budget it passed last week.

That’s because Santa Clara’s finances are joined at the hip to the one of the world’s most volatile economic sectors – technology.

The largest share of Santa Clara’s general fund – the budget for City services – comes from business sales tax, which is roughly 45 percent of general fund tax revenue and 32 percent of all general fund revenue. Santa Clara has had an object lesson in this volatility over the last 15 years. And given the Brexit turmoil it’s not likely the lesson isn’t over.

Here’s how Britain’s vote to leave the European Union could affect Santa Clara’s revenue. The value of the dollar has gone up, driving up overseas prices for goods exported from the U.S. Businesses will either reduce prices or have fewer sales. Either way, less revenue means less sales tax. Nearly 60 percent of U.S. technology companies’ sales are overseas.

The tech economy operates in boom-and-bust cycles – 1985, 1992, 2001, 2008. The last one was the dotcom boom, which cratered in 2001. We’re now in a similar “growth trumps profits” boom, this time the investment capital sweethearts are mobile app companies like Uber – currently valued at $62 billion, more than car manufacturers Ford and GM. And some say the writing’s on the wall.

One of the city’s largest payers of sales tax, Intel, recently laid off 12,000 employees, about 300 in Santa Clara. The company also gets 80 percent of its revenue from overseas sales, largely in Asia, according to a 2015 report in USA Today.

Compared to the same time last year, Bay Area tech layoffs doubled in the first four months of 2016, according to a May 11 report in the Mercury News. And despite the Saudi $35 billion Uber investment this month, financial experts have been reporting a slowdown in venture capital fundraising and investment since the end of last year.

That Santa Clara’s top revenue source is sales tax is not an accident. The City’s growth strategy in the 1960s and 1970s was to create a favorable environment that would draw high tech business to the Northside.

That strategy paid off. The technology businesses came and sales tax revenue grew as businesses grew. This turned out to be a boon when Prop 13 cut municipal property tax revenues by about two-thirds, and froze revenue growth to two percent a year. (The Santa Clara County Tax Assessor estimates that 25 percent of the tax roll is still assessed at 1975 rates, and only 25 percent is at 2015 assessments.)

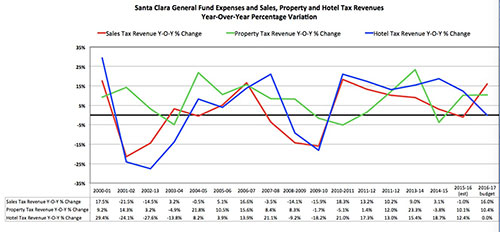

But sales tax has its downside and that’s volatility. Sales tax revenue increased nearly 18 percent in FY 2000, only to drop almost 22 percent the next year. In six of the last 15 years, the City’s sales tax revenue has dropped; four of those years it dropped between 15 and 22 percent.

Even though sales tax revenues have been growing for the last five years, 2015-2016’s estimated sales tax revenue of $49.4 million is still under the 2000-2001 peak of $51.1 million. Hotel tax tracks sales tax and is likewise volatile.

Property tax revenue has grown over the last 15 years, and now makes up 37 of general fund tax revenues – compared with 19 percent in 2000-2001 – and 22 percent of all general fund revenue. While not as volatile as sales and hotel tax revenues, property tax revenue has declined in four of the last 15 years. Property taxes also lag behind other economic factors.

Without new development, a city’s property tax revenue will soon fall behind the costs of providing public services. California municipalities can’t levy income taxes but they can levy fees for services. (San Francisco’s city income tax is called a “payroll fee.”) Redevelopment agencies, which collected the incremental property tax on redevelopment projects, were another avenue by which cities could increase revenue post Prop-13.

The balance of Santa Clara’s general fund revenue comes from the City’s municipal electric company ($19.7 million, called “contribution in lieu”), lease revenue ($11.4 million), and fees and charges for permits and services ($35 million).

In coming weeks we’ll take a look at Santa Clara’s general fund expenditures and reserves in light of its revenue volatility.