California’s pension “crisis” has been brewing for a while. But recently things got worse.

That’s because the California public pension system, CalPERS, decided to reduce the time public agencies have to pay off their unfunded liabilities by 10 years—the difference between the pensions that are owed and the money that’s expected to be in the system to pay them.

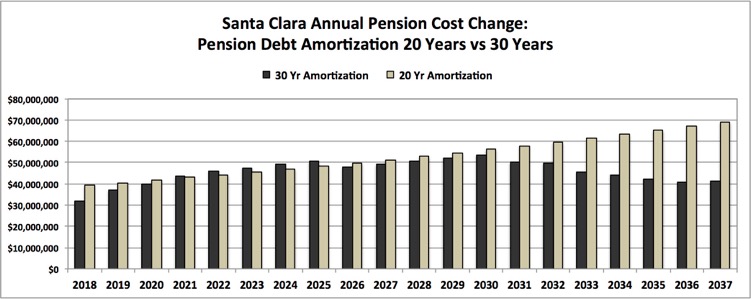

While in the long term it will cost Santa Clara about $100 million less to pay off its long term pension debt, in the short term the City will pay $150 million more in pension costs between 2018 and 2037. Santa Clara’s current pension debt is about $420 million, according to CalPERS most recent published numbers (2015).

CalPERS’ July 2017 actuarial analyses—Miscellaneous Plan Of The City Of Santa Clara and Safety Plan Of The City Of Santa Clara—lay out year by year how the changed amortization will affect Santa Clara. The analysis, which is what CalPERS uses to set contribution rates and amounts, is based on 2016 information. The reports show amortization over 30, 20 and 15 years.

Changing the amortization period from 30 to 20 years adds up to an additional $10 million over the course of the current five-year planning horizon, starting with a $7 million jump in 2018. While increases are slow between 2024 and 2031, in 2032 the additional costs grow by double digits, adding a total of $154 million to Santa Cara pension costs over the 20-year span.

To put that in perspective, that’s about the original estimated cost to build a new recreation and aquatics center in Central Park—a project that is currently deemed unaffordable. It would certainly rebuild the existing swim center several times over.

With $116,000 in City deficits already projected between 2018-19 and 2022-23, the additional costs will drive up the cumulative deficit to nearly $127 million. The added costs will nearly double the projected 2018-19 deficit, bringing it to $16.2 million. At that rate, the current operating reserves ($54 million) will be depleted in less than three years.

The City’s pension costs are already escalating as a result of CalPERS 2017 reduction of its discount rate—expected rate of return from its investments—from 7.5 percent down to 7 percent.

Independent analysts such as Joe Nation, Professor at the Stanford Institute for Economic Policy Research and manager of the California Pension Tracker website (www.pensiontracker.org) say CalPERS is still overly optimistic about returns and should be using a 3 to 4 percent discount rate, which they say is a more accurate reflection of investment market reality.

Santa Clara’s pension debt has accumulated since 2000, when the City had a $30 million surplus in its CalPERS account and declared a pension contribution “holiday.” The holiday was followed by the dot-com “crash,” which had enduring effects on CalPERS.